How to streamline expense reconciliations

October 4, 2023

By Tori McBride

Defining expense reconciliation

Expense reconciliation is a critical aspect of financial management for any business. At its core, it involves matching the actual expenses incurred by your business with the entries in your accounting ledger. This process includes cross-referencing receipts and invoices against expense claims and transaction histories to provide a panoramic view of your organisation’s financial health.

Benefits of a streamlined expense reconciliation process

The benefits of streamlining the expense reconciliation process cannot be overstated. Not only does it save your finance team valuable time and money, but it also enhances the accuracy of financial reporting, leading to more informed decision-making and greater overall financial health for your business.

Improved accuracy in financial position

One of the primary advantages of an automated expense reconciliation process is the enhanced accuracy it brings to financial statements. Making it easy for staff to provide information leads to greater accuracy when matching expenses with their corresponding receipts and invoices, which also serves as a safeguard against costly errors when preparing financial reports.

This level of precision paves the way for greater transparency and improved reporting, empowering stakeholders to make more informed decisions that are grounded in precise data. Furthermore, this approach simplifies the audit process by streamlining the extraction of receipts.

Reduced human errors

Automation plays a pivotal role in streamlining the expense reconciliation process. By automating critical tasks, such as the calculation of GST for each transaction, errors caused by manual calculations can be significantly reduced. Inaccuracies are often the result of simple human error, so automation can effectively eliminate the source of these miscalculations and discrepancies.

Reallocate sunk time

Time is money. And automating your expense reconciliation process saves you both. When your finance team is able to spend less time labouring over manual reconciliations, they gain the capacity to focus on higher-value tasks that actually drive growth and innovation within your organisation. This time reallocation could also have a knock-on effect across your entire organisation.

When your finance team is operating at its full potential, other departments also benefit. Whether it's marketing, operations, or sales, when financial data is more readily available, it empowers these teams to make informed decisions with a clear understanding of their budgetary constraints and opportunities.

Greater visibility over business expenses

A streamlined expense reconciliation process offers businesses greater visibility over their expenses. Automation enables real-time expense monitoring, creating a meticulous record of all costs. This level of visibility allows for the swift identification of discrepancies or errors which can then be rectified quickly and efficiently. The longer you wait to chase a receipt or request a chargeback, the more drawn out this process becomes.

Close the books faster

The efficiency of your expense reconciliation process has a direct impact on the speed at which you can close the books at month-end. Every extra day spent on communicating the prior month’s results delays action and prevents your finance team from carrying out higher value work. For expert guidance on how to close the books faster, download our Month end close checklist.

What a streamlined expense reconciliation process looks like

Digital receipts

That pile of paper receipts in your desk drawer isn't going to cut it anymore. Leveraging digital receipt technology, such as Slyp, is a step in the right direction. Receipt capture tools use OCR (Optical Character Recognition) technology to digitally record expense information, eliminating the need for paper receipts altogether.

Automated expense reports

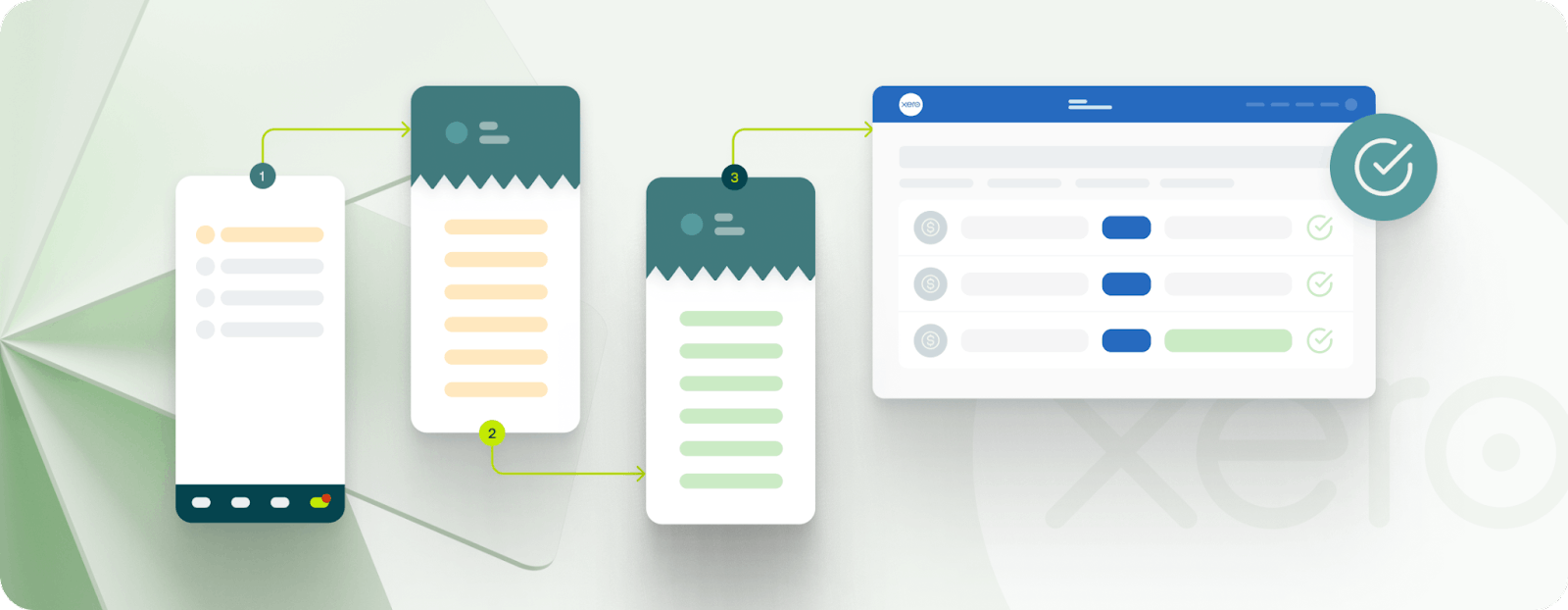

While digital receipts are a great starting point, automating expense reports takes this process one step further. By automating the transfer of expense reports to your accounting system, you can eliminate the need for any additional manual work once the transfer is complete.

Many expense management systems, including Weel, integrate seamlessly with leading accounting platforms like Xero, Quickbooks and MYOB. These integrations allow you to automate the categorisation of expenses to your GL (General Ledger) codes, further streamlining the reconciliation process. Even without a direct integration to your accounting software, there are many ways to automate an import journal into your ERP.

A spend management solution that automates your expense reconciliation

Effective expense management is paramount to the success and resilience of any business. As Australia's leading spend management tool, Weel tracks all business expenses and automates the management of these expenses.

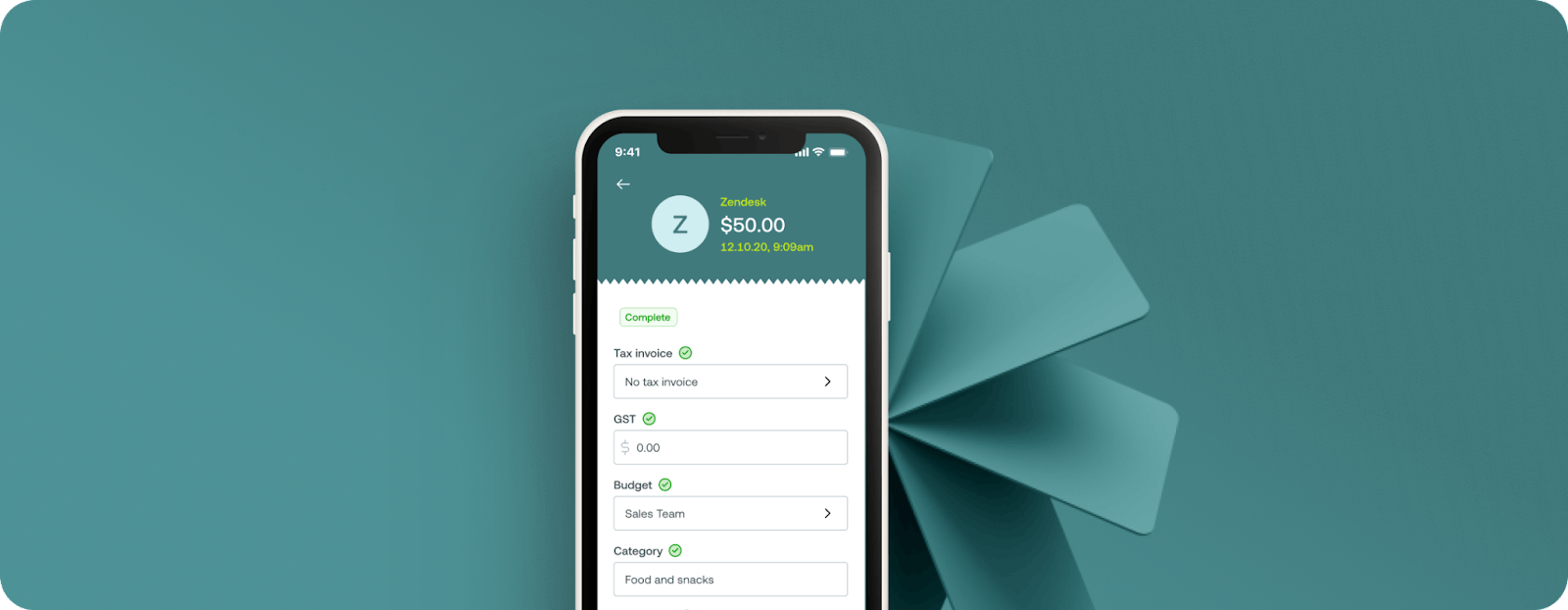

From the time a payment is made, all the way to the moment it lands in your accounting software, Weel guarantees complete expense reports with accurate data, which are all readily available in real-time.

Book a demo with one of our spend management experts to discover how Weel can help you streamline your expense reconciliation process today, for a brighter financial future tomorrow.