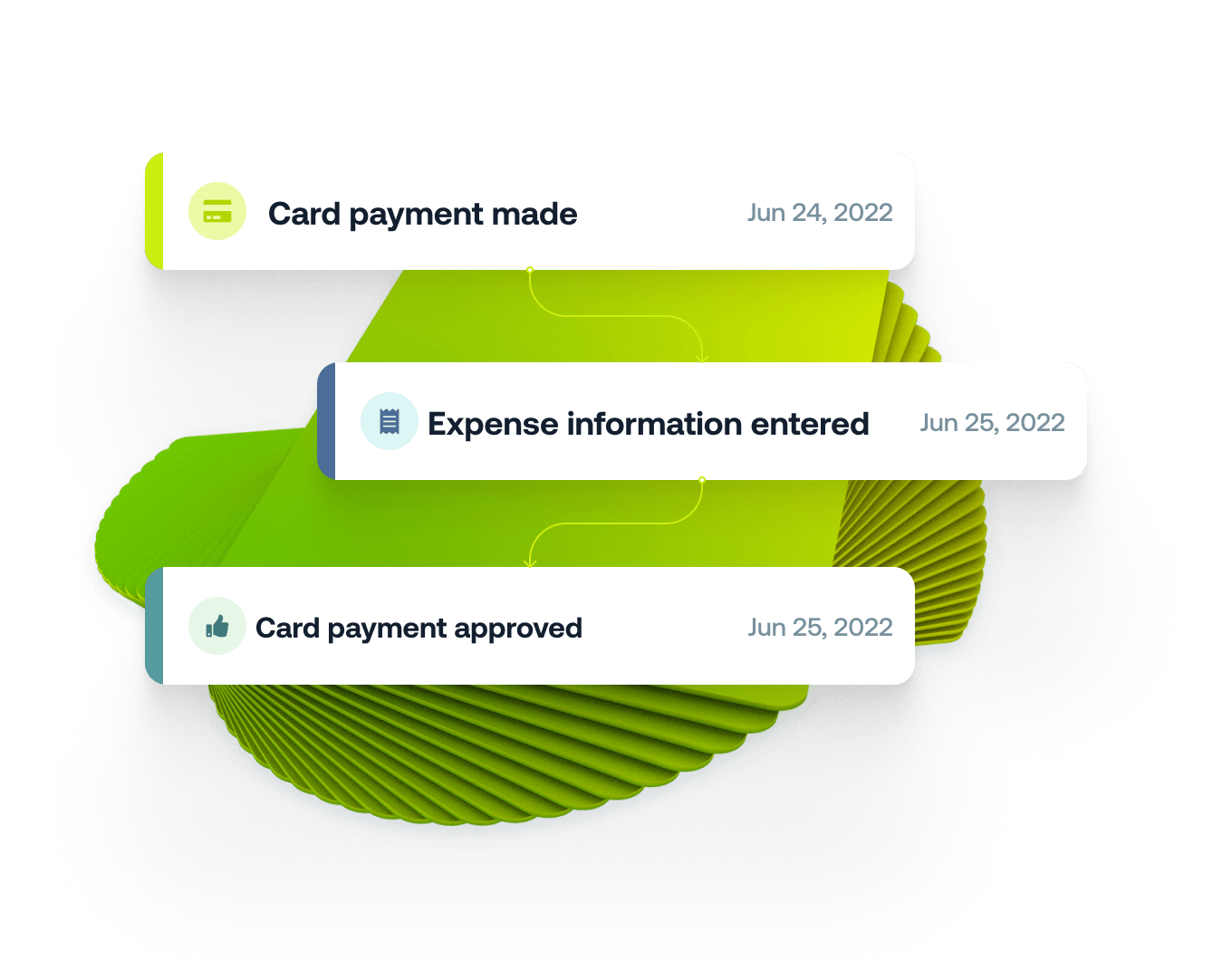

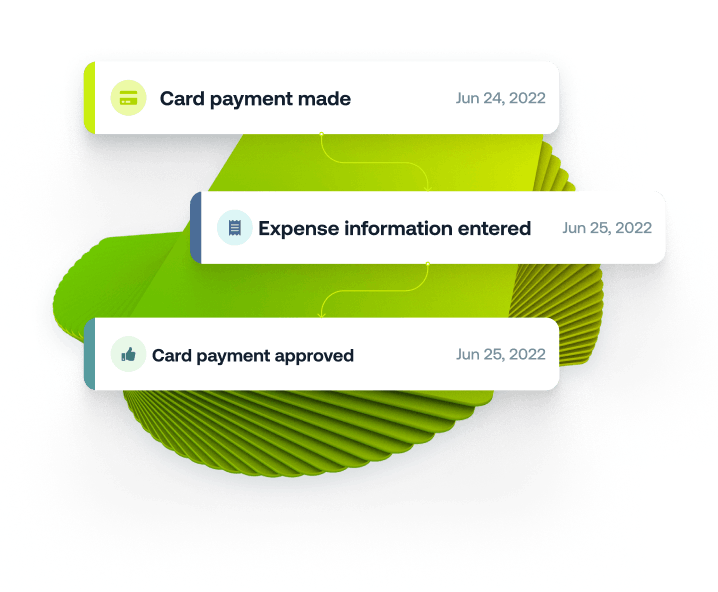

Every payment accurately accounted for

With instantly issued virtual cards, you can say goodbye to card sharing and the mystery expenses on your monthly statement. Capture exactly what has been spent, where it was spent, and who spent it.

Using our modern virtual cards and leading spend management tools, expenses are captured accurately, as payments happen. Your reconciliation process and month-end close just became a piece of cake.

With instantly issued virtual cards, you can say goodbye to card sharing and the mystery expenses on your monthly statement. Capture exactly what has been spent, where it was spent, and who spent it.

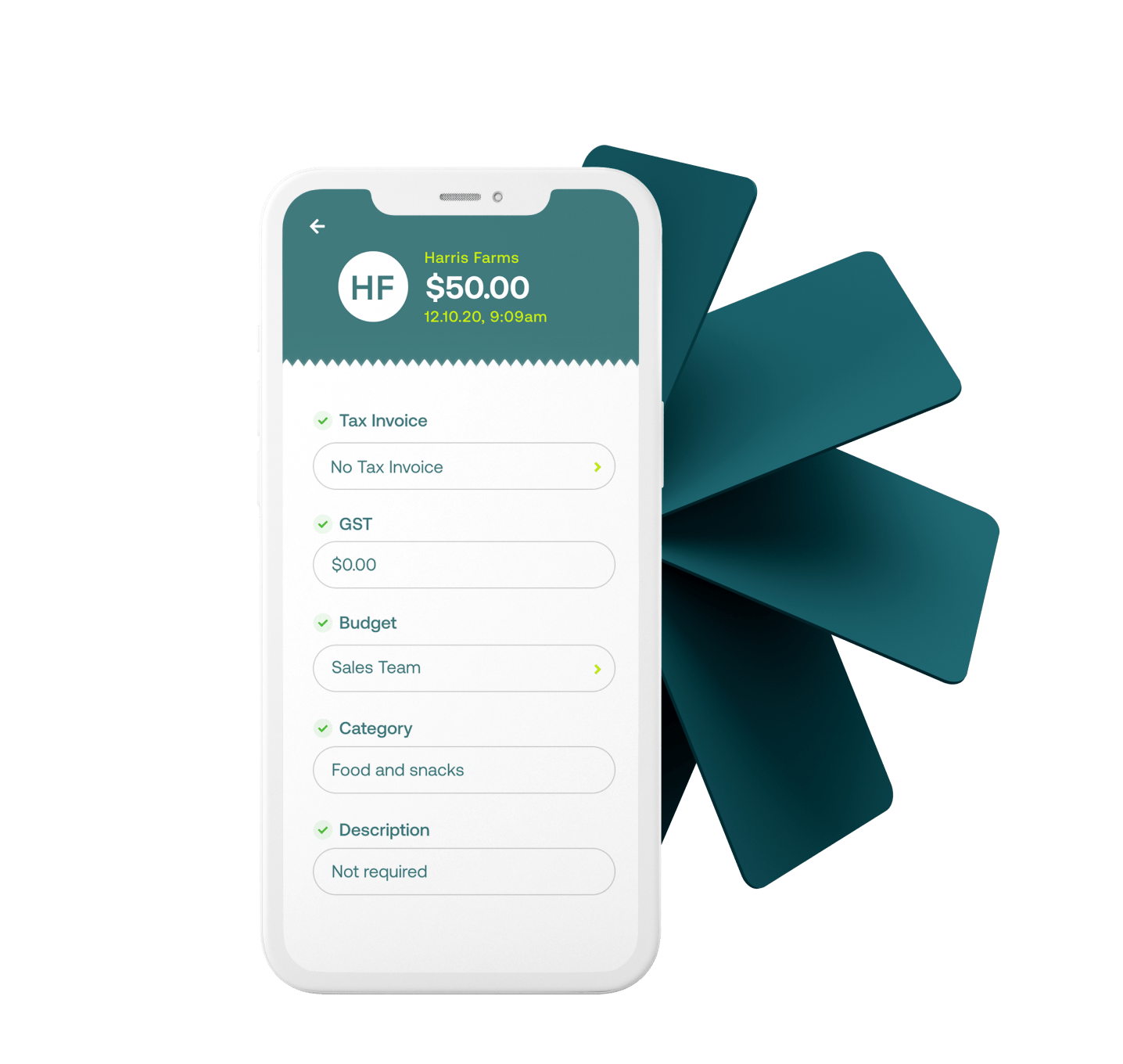

Adios, paper receipts. Using our in-app receipt capture and streamlined expense report capture, you get all the accounting details you need on every purchase. As an additional step, you can set an approver to check reports as they’re completed.

Forget waiting for a credit card statement to arrive, and trying to trace back expenses over the month. With every expense pulled into Weel in real time, you can use our transaction table to stay across every expense as it happens.

By mapping all your general ledger codes and categories into Weel, your transactions will sync with your accounting software the minute it has been approved. With every payment already matching what’s in the ledger, you’re ready to reconcile and close your books.

Daniel, Financial Accountant, Capterra

How does Weel help with credit card reconciliations?

With Weel, every transaction is pulled into Weel's transaction table in real-time, allowing you to automate your reconciliation process. Once an expense report is complete, you can send these straight into your accounting system.

Does Weel integrate with other systems?

Weel integrates with leading Accounting systems such as Xero, Quickbooks and MYOB. For other accounting softwares you can use Weel’s smart filters and exports to generate a custom CSV ready for import into your system.

What is a virtual card and spend management solution?

A virtual card is a digital version of a physical card. They work the same way plastic cards do but live in your smartphone instead of in your wallet. Weel’s virtual cards connect to its spend management system which allows you to manage all types of spend in your business from one place.

Can I see my expenses in real-time?

Yes, Weel’s transaction table lets you review all transactions made, along with a photo of the receipt once uploaded into Weel’s app.

Credit card reconciliation is an essential process for ensuring that all transactions are accounted for, detecting any discrepancies or errors, and making sure that the books are closed accurately and on time. While the process can be daunting for many, with the right tools, it’s possible to make credit card reconciliation a breeze.

Credit card reconciliation is the process of matching the transactions recorded by a business’s accounting system with a corresponding credit card statement. The purpose is to ensure that all credit card transactions are accurately recorded and no errors have occurred, such as double billing or incorrect payments. Any discrepancies should be investigated and corrected. Additionally, the reconciliation process should include a review of the credit card fees and interest charges to ensure that the business is not being overcharged.

At its core, credit card reconciliation requires two documents: the statement provided by your credit card company and the general ledger in your accounting software. The process begins when you compare the charges listed on the statement with those recorded in the ledger. For each entry on the statement, you should look for the corresponding entry in the ledger. If there is no corresponding entry, you should investigate why this is and contact the employee the card belongs to or the credit card company if needed.

If you identify any discrepancies between the statement and the ledger, you must make the necessary adjustments to the ledger. This could involve adding a new entry, deleting an existing entry, or changing the amount of an existing entry. Once all discrepancies have been addressed, you need to then reconcile the statement with the ledger. This involves ensuring that the total amount of the statement matches the total amount of the ledger. Once this is done, your credit card reconciliation is complete.

1. Ensuring all transactions are posted to the ledger

Make sure that all transactions on the statement have been posted to the ledger and make sure that each transaction has the appropriate number of ledger entries.You may want to establish a procedure to ensure future transactions are accurately posted. This involves regularly reviewing transaction details for accuracy and making sure that payments are recorded both in the ledger and with the credit card company.

It's important to ensure that all transactions are properly coded and that the correct accounts are used. You should review the statement for any discrepancies or errors and make sure that all transactions are properly documented. Finally, you should reconcile the statement with the ledger on a regular basis to ensure accuracy and to identify any discrepancies.

2. Recording Transactions and Balances

The next step is to enter the transaction details from the statement into your accounting system. Make sure that all entries are accurate and that all payments have cleared. It’s also important to review the balances in both systems and adjust them accordingly. This step helps ensure that all of your accounts are in sync.

It is important to keep accurate records of all transactions and balances. This will help you to identify any discrepancies or errors that may have occurred. Reconciling your accounts on a regular basis helps to ensure that all transactions are accounted for and that your accounts are up to date.

3. Detecting and Resolving Discrepancies

The next step is to look for discrepancies between the statement and ledger. This could involve discrepancies in amounts or dates, as well as items that have not been posted or paid properly. If you spot any discrepancies, contact the credit card company to figure out the best way of resolving them. You might need to make adjustments and recalculate balances if necessary.

It is important to keep track of any discrepancies that you find and document the steps taken to resolve them. This will help you to ensure that the issue is resolved correctly and that the customer is not charged for any incorrect fees. Additionally, it is important to keep a record of any communication with the credit card company, as this can be used as evidence if the customer disputes any charges.

4. Analyzing Trends in Credit Card Reconciliation

Once everything has been checked and reconciled, it's important to identify any trends or patterns in your credit card activity. Look closely at how much is being charged each month, any discrepancies that occur regularly and how often payments are made on time. This will help you gain a better understanding of your spending habits, enabling you to make better decisions in the future.

By taking the time to double-check all entries and ensure accuracy, you can avoid costly mistakes and ensure that your credit card reconciliation is accurate and up-to-date.

To avoid such errors, it’s important to check each entry multiple times to ensure accuracy.

For businesses that process a significant number of daily transactions, traditional corporate credit cards can make the reconciliation process complex and time-consuming. With a large number of transactions, it can be challenging to reconcile each one accurately, and this process can take several days to complete. Automation can help speed up the process by enabling you to quickly match transactions between systems. A virtual card and spend management system, like Weel that handles the payment and sends the transaction to your accounting software, is a great solution.

Using a virtual card and spend management solution helps companies to close their books faster at month-end. With traditional corporate credit cards, it can take several days to reconcile each transaction. Virtual cards and spend management software make it easier to reconcile transactions, and provide real-time visibility into spending patterns, allowing companies to close their books faster and more accurately. Avoid costly errors and save time by streamlining your process for reconciling expenses with a spend management system.