How Michael Hill saved 870 hours of in-store expense admin with Weel

With Sarah Jennings, Banking and AR Manager at Michael Hill

With Sarah Jennings, Banking and AR Manager at Michael Hill

Location

Australia, New Zealand and Canada

Industry

Retail - Jewellery

A jewellery retailer founded in New Zealand in 1979 with a vision to make fine jewellery accessible to everybody. Michael Hill Jewellers has grown to be one of the largest jewellery retailers in the world, with over 300 stores across Australia, New Zealand and Canada.

Challenges

Payments made via handwritten bank cheques

Fraud and wasteful spending

Lack of spending visibility and control

Manual data entry and physical paperwork

Michael Hill saved 870 hours of in-store expense admin with Weel. Learn how Banking and AR Manager Sarah Jennings was able to achieve this with Weel.

A jewellery retailer founded in New Zealand in 1979 with a vision to make fine jewellery accessible to everybody. Michael Hill Jewellers has grown to be one of the largest jewellery retailers in the world, with over 300 stores across Australia, New Zealand and Canada.

Being an international retailer comes with some major challenges for financial operations. How do you manage payments and reporting for high frequency purchases on things like staff amenities, stationary and cleaning across 300 plus stores across 3 different countries?

Banking products, specifically traditional corporate cards, have struggled to keep up to date with businesses operating globally. The lack of accessibility, scalability and control of corporate cards meant that Michael Hill had to rely on blank cheque books and keeping track of paper receipts for store related employee expenses. This process opened them up to fraud risks, restricted spend visibility and meant that a minimum of 50 hours would have to be spent each month on bank reconciliations.

Believe it or not but this process gave Michael Hill’s finance team more spend control than what a traditional corporate card solution could provide.

For over 8 years, Sarah Jennings (Banking and AR Manager) had been looking for a new way to manage store expenditure. Cheques were closer and closer to being obsolete, fraud wasn’t being uncovered for months - sometimes even years - down the track, and each store manager was spending 4 hours per month on expense reporting.

Sarah was in search for a tool that was “easy to use and quick to capture expense data for the store staff and the banking team”. They also required a tool that gave them full control of employee spend and “a system that would be easy to set up new staff, remove departing staff and keep up with employee movement across stores”.

With Weel's card controls, detailed expense reporting and the ability to instantly issue and cancel employee cards, it was the perfect solution.

After 2 weeks of product evaluation, Michael Hill Jewellery was ready to roll out the Weel virtual corporate card and expense management platform.

“With the support of Weel's implementation team, we rolled out 200 virtual Mastercards in the first day and Weel support handled all questions as they arose”

In transitioning away from traditional banking products, Michael Hill Jewellery has gained full control in administering and managing their own corporate card program. With smart cards bound to internal expense policies rather than spend limits defined by a bank, they have effectively streamlined and automated their employee expense processes.

Today, with 294 staff members using Weel's virtual corporate cards and expense reporting, Sarah and her team have removed the cheque books and paper receipt handling. Staff members quickly tap and pay, snap a photo of their receipt and complete their expense report all from Weel's user-friendly mobile app.

This has cut down 82% of time spent on expense admin in each store - a total time saving of 870 hours every month.

With tax invoices, GST, budgets, descriptions, and all merchant data instantly available, the accounting team is able to quickly code each transaction and import them into their account system. This has eliminated the manual data entry and reduced overall processing time by 70%.

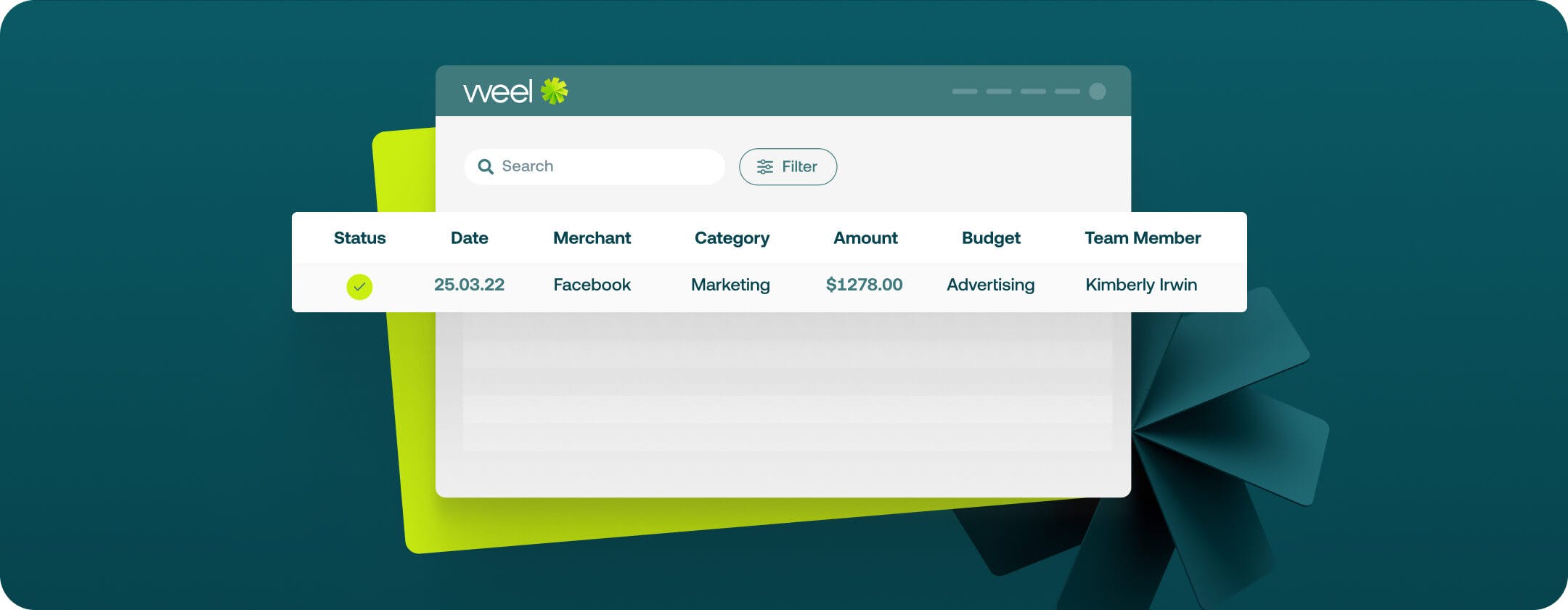

The ability to track spending against monthly budgets in real-time has given the banking team better visibility of expenditure in each store. And if they ever need to review a transaction in more detail they can simply open a transaction from Weel's live transaction feed and review all transactional and expense data. To provide even more context around each transaction, Sarah has added a description field to her staff’s expense reports. The field requires staff members to enter why a transaction has been made at the point of purchase.

The end result? Store managers and staff who have the time to make Michael Hill the most loved jewellery destination.