Take your school cashless

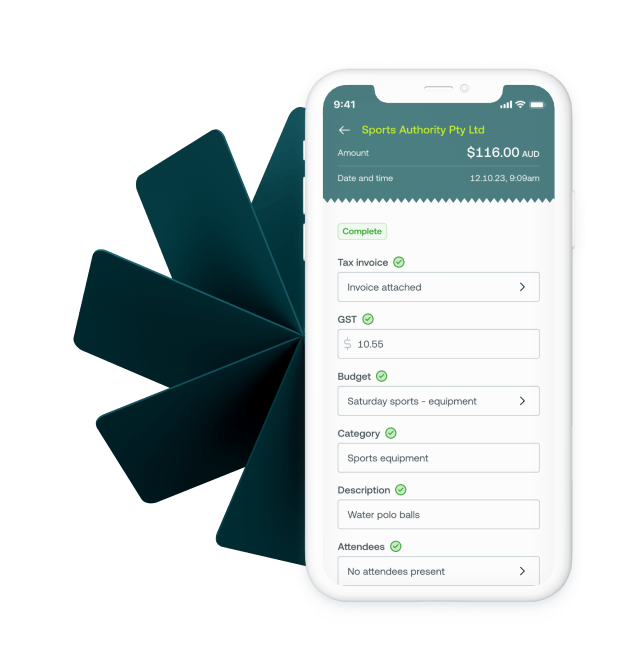

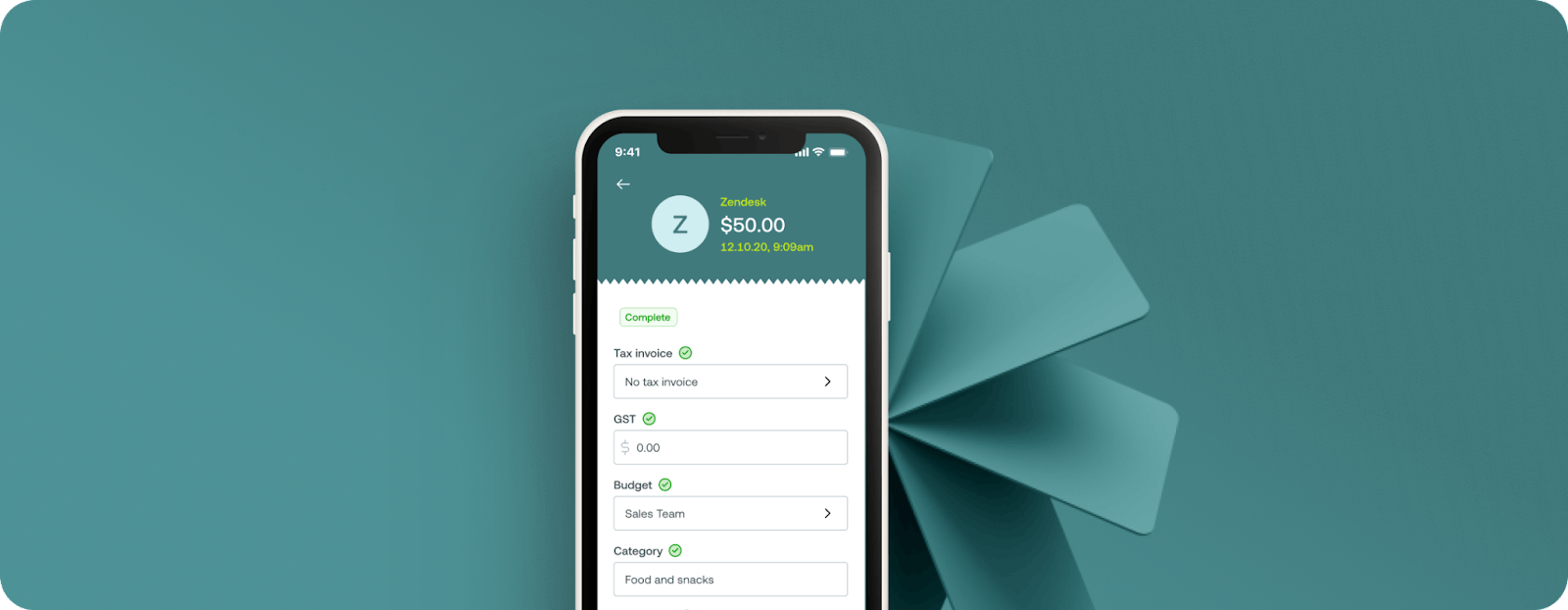

Forget time-consuming imprest systems. Weel's Visa Business debit cards serve as the perfect alternative to petty cash. Instantly issue virtual debit cards to staff members without the hassle of paperwork, providing a convenient and secure way to pay for classroom supplies, excursions, food and more.