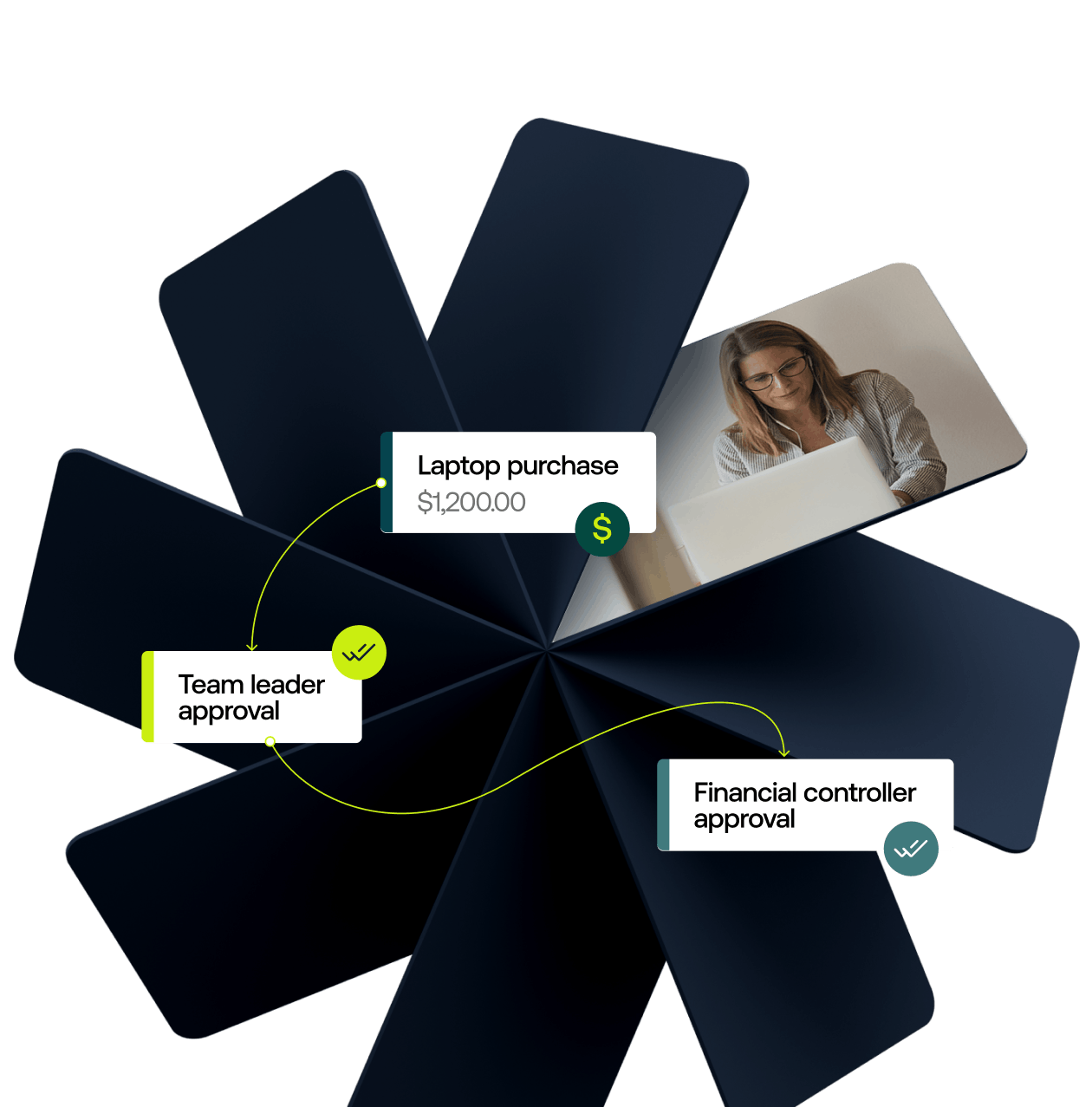

Share the load and create collective spending accountability

With multi-level approval workflows, you can set the rules to ensure all company spending has the right sign-off. With less time spent in the weeds on every transaction, finance teams can spend more on strategic finance.