Real World Group uses Weel to solve three key business challenges and save half a day a week

With Andrew Yager, CEO at Real World Group

With Andrew Yager, CEO at Real World Group

Location

Macquarie Park, NSW, Australia (HQ)

Industry

IT - Managed Service Provider

IT provider, Real World Group (RWG) delivers hardware and software solutions, as well as a carrier grade national network. The organisation began in 2000, and proudly services their customers - many long-standing - from their head office in NSW.

Challenges

Wanted to save time on expense management

Required a better way to enable ad hoc purchases to meet customer needs

Desired an impactful way to reward staff

Discover how IT provider Real World Group (RWG) improved their customer service and employee engagement with Weel's virtual business cards. Read more.

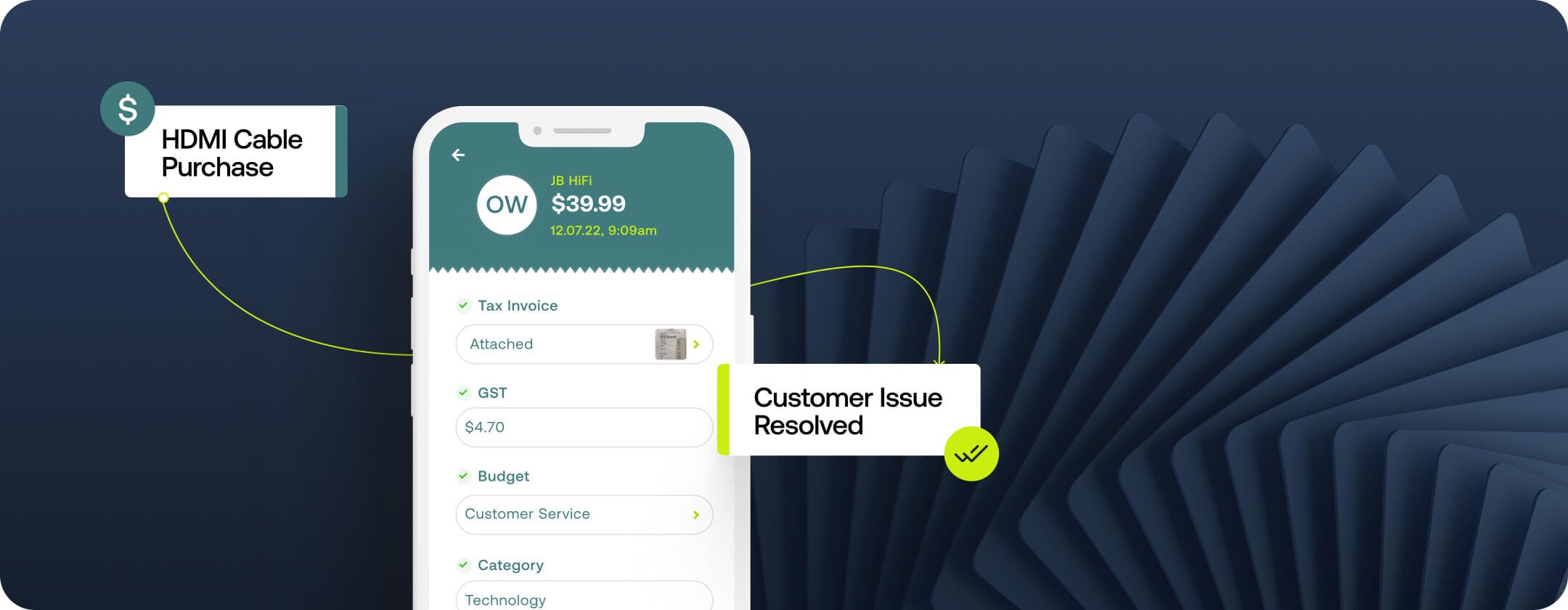

The RWG engineers frequently work on site for their customers. Often a new piece of hardware is required to resolve an issue. RWG engineers need a quick and easy way to purchase what’s needed and get on with the job as soon as possible.

Previously, RWG employees were:

Using employee funds or a shared credit card for expenses caused problems down the line.

RWG also wanted a way to easily reward their staff. Adding a small amount to someone’s pay isn’t nearly as impactful as giving them a discrete gift; RWG needed a better way to engage with their valued workforce.

Like many SMBs, RWG struggled to find a banking product that would meet their expense management needs. CEO, Andrew Yager searched for a solution and came across Weel. After the initial Weel set up – started Saturday afternoon, finished Monday morning – Andrew was able to offer instant virtual business cards to his employees, with funds tied to fixed budgets and spending limits.

As Andrew explained:

‘In the past, on-site engineers were reluctant to spend $40 of their own money on an HDMI cable to connect a customer’s computer – and that’s fair enough. So, I needed a way to provide expense cards to my engineers and to control the spend on those cards. Weel has solved that problem for me.’

When a RWG employee makes a purchase on their Weel card, the details of the purchase are seamlessly fed back to their accounting system: Xero. Not having to fill out arduous expense claim forms is another benefit of implementing Weel.

Andrew said:

‘Our expense team used to spend hours chasing expense claim information. Now the process is incredibly simple, and it’s easy to prompt people for more details if needed. Weel has given us structure and control over our expense management.’

Weel has achieved a threefold solution for RWG. Using virtual business cards has:

RWG is saving three to four hours each week on time previously spent doing reimbursement admin. Their CFO is no longer losing unnecessary time on expense-related paperwork, and Andrew has reclaimed the hours he used to spend chasing employees for missing information.

Andrew stated:

‘Using Weel for our employee expense management has saved us huge amounts of work – all the information is readily available through Weel and it’s easy to reconcile. The data is also accurately reflected in Xero.’

All employees at RWG have now been issued with a Weel card. This means:

Andrew said:

‘We have multiple budgets. With all our employees now set up with a Weel virtual card, we can easily select who can spend against which budget, and how much they can spend. Our employees are able to provide a higher level of customer service to our clients because they have access to the funds they need to get their jobs done.’

Weel is a great tool to deliver employee rewards. RWG knew that NSW and Victoria were having a hard time with the lockdowns, and they wanted to do something for their staff to recognise this.

In the past, this reward might have been a little bit extra in people’s pay as a one off. RWG decided to use Weel this time, so the extra spend would more easily be set aside for employees to treat themselves.

Andrew explained:

'We wanted to put our employees in control of how they spent this reward. The idea was that they would buy something nice for themselves, in light of how hard the COVID-19 restrictions have been. Adding the funds to our employees’ Weel cards showed them our appreciation, and provided discretionary spending in a way that was dynamic and flexible.’