3 ways to overcome internal resistance to finance automation

March 2, 2022

By Ben Grossberg

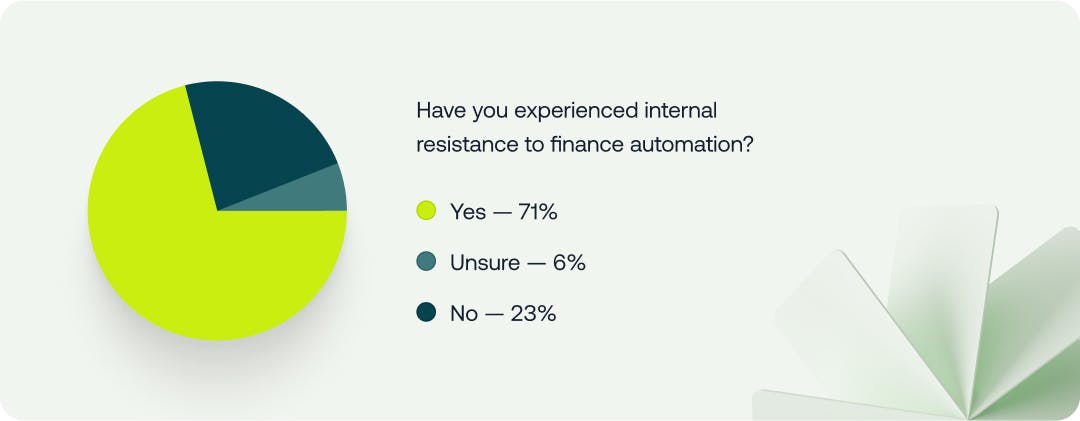

Weel's recent webinar: How to automate finance for today and tomorrow, asked attendees: ‘Have you experienced internal resistance to finance automation?’. Over 70% of respondents said that yes, they have!

Resistance to automation can come from lots of different stakeholders: employees, the C-suite, suppliers, etc. And resistance can occur at varying stages in the project: sourcing the software, sign off, implementation, and ongoing use.

Here are three resistance scenarios and how to tackle them:

- Unsolicited suggestions from other teams

- C-suite not cooperating

- Fears in the finance team

Giving fair consideration to suggestions from other teams

As anyone who has ever led on an automation project can tell you, lots of people in the business are likely to have an opinion on it. Weel recently surveyed 500+ CFOs, and discovered that close to 70% of respondents had experienced pressure from other departments about finance automation.

So, what can you do when John from procurement comes knocking at your door to suggest an alternative to the automation tool you’ve been researching?

Firstly, don’t dismiss John out of hand. Yes, you may have already shortlisted the tools you want to choose from, but perhaps John has a perspective that you haven’t previously considered. Maybe the solution John is suggesting would work well for both finance and other teams in the business, whereas you’d mainly focused on how the tool would benefit the finance team.

If you encounter resistance to a new automation tool at the research stage, this is the ideal time to consider other options. By hearing people out, you can then bring those who have a vested interest in finance automation on the journey with you.

Securing the C-suite’s cooperation for implementation

You’ve chosen your new automation tool, and as CFO, you had a relatively easy time getting your fellow C-suite to sign off on the costs – if you needed their sign off at all. But agreeing on costs and getting actual support for implementing a new software system are two very different kettles of fish.

If you’ve chosen a new all-in-one spend management tool, like Weel, that system will touch most if not all areas of your business. Imagine you’re about to roll out digital corporate cards for business purchases, and CMO, Jane, queries why her team can’t continue to use her credit card – all the card details are conveniently photocopied and pinned to the notice board in her office.

To overcome Jane’s resistance to change, you need to explain how the new secure spend management tool will help her. Jane will no longer need to worry about her team going over budget or maxing out her card on expenses she wasn’t aware of. She’ll also save herself a lot of time in chasing up who spent what, because Weel automatically assigns purchases to set spending lines.

As Russell Colbourne FCCA GAICD, CFO at CFO Centre Australia states in ‘Automating Finance: Wins, challenges and what’s next’:

‘When finance wants to introduce a new system, resistance can be felt when the wider business thinks, why would I want to spend time learning something new to do the same job? Because that’s effectively what we’re asking them to do. In the background, the administration is much more streamlined; but that’s not their problem. So, it’s critical for finance to find ways for finance automation to help everyone, and to really sell that into the business.’

Overcoming fears in your finance team about job losses

It’s normal for people to be apprehensive about change. When a new tool is introduced that will reduce workload, it’s best for the CFO to pre-empt employee concerns about where their time will now be spent.

40% of surveyed CFOs revealed that the time they’ve saved through automation has been funnelled into higher workloads and business growth. This provides reassurance for employees who worry that the main reason for automation is to reduce headcount.

So, when James and Lauren, your two finance apprentices, raise concerns about job security due to a lack of data entry, you can assure them there’s plenty of other tasks for them to do! For example, you’ve identified that some of the business’ apprentices from other departments are tardy with their timesheets – perhaps James and Lauren could brainstorm ways to improve compliance in this area.