Smart cards, smarter spending

Shared cards, be gone. Issue instant virtual cards with built-in spending rules, so that sticking to the expense policy is second nature.

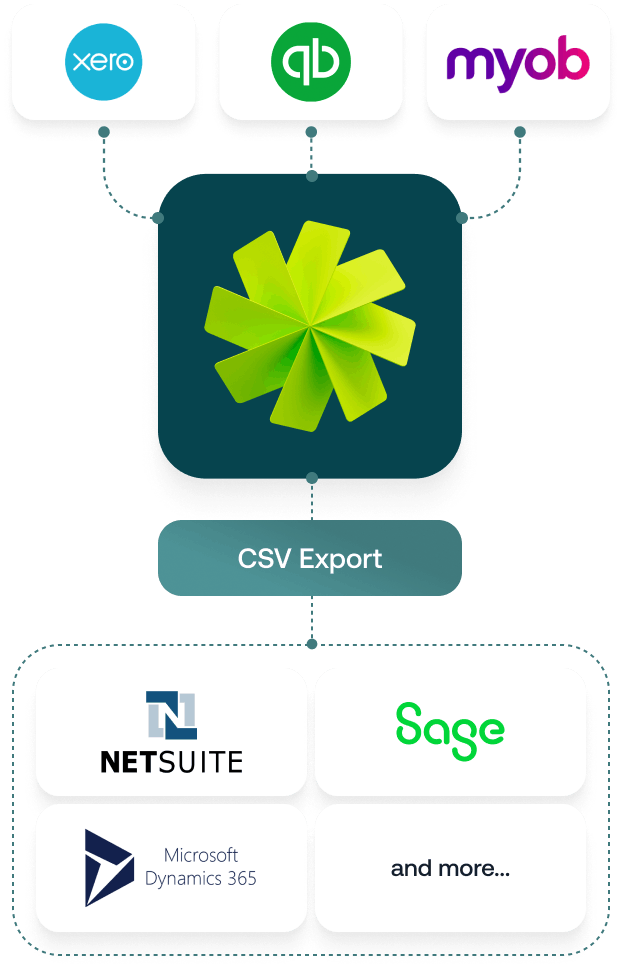

Want to control spending while freeing up your finance team? Meet Weel. Smart corporate cards, reimbursements and easy-to-use software built for finance efficiency.

Shared cards, be gone. Issue instant virtual cards with built-in spending rules, so that sticking to the expense policy is second nature.

Our virtual cards come packed with powerful features to ensure in-policy, secure spending.

Track and manage all your company subscriptions without having to leave Weel.

Set up multi-level approval flows and payment scheduling to pay your bills on time.

Hey small spender, submit reimbursement claims on the go and get paid back sooner.

Welcome to a world of features that simplify spending and keep your business moving. With these tools, insights and controls, everyone in your team wins.

Avoid awkward expense questions altogether. Create spending rules and budget limits that mimic your company’s expense policy.

BudgetsBuild custom approval flows that help keep company budgets in check, without holding your team back from purchasing the things they need.

WorkflowsGet the complete picture on company spending, without waiting for a bank statement. See each transaction as it happens with a live feed.

Transactions“I found that receipt from 6 months ago,” said no one, ever. Track and manage all spending data using Weel as your platform of record.

Try for freeTurn month-end marathons into one accurate, low-touch experience. Weel makes work easier for everyone.

Sign up for a free, two-week trial, and never look back.

Build in crystal clear expense rules that are, well, impossible to break.

Empower everyone from the new intern to the CEO with their own unique card, so they can tap and go with Apple Pay or Google Pay.

Use your Weel card and capture receipts in the app. No out-of-pocket costs. Zero, zilch, nada.

Set up all your recurring subscriptions and bill payments in Weel and see spending trends as they emerge.

“We were looking for a tool that was easy to use and quick to capture expense data. With Weel, we have now saved 870 hours on expense admin every month and seen a 70% reduction in processing time.”

Issue virtual cards in minutes. No paperwork. Cancel any time.